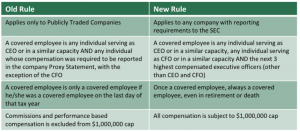

Recently, the IRS issued Notice 2018-68, providing guidance under Section 162(m) of the Internal Revenue Code, as amended by the 2017 Tax Cuts and Jobs Act (the “2017 Act”). Section 162(m) disallows the deduction of compensation paid by public companies to covered employees to the extent such amounts exceed $1 million per year. The 2017 Act changed the definition of covered employees, expanded the entities subject to Section 162(m), and eliminated the exception for commission and performance based compensation. Application of the new rules commences in 2018, except that compensation paid pursuant to a binding written contract that was in effect on November 2, 2017, is grandfathered as long as such contract is not material modified after that date.

Changes to a Covered Employee

A covered employee is defined as including any employee who is (or is acting as) the principal executive officer (PEO) or principal financial officer (PFO) of the publicly held corporation at any time during the tax year. In addition, a covered employee includes any employee among the three highest-compensated officers for the tax year (other than the PEO or PFO) as computed under the Securities Exchange Act of 1934, even if his or her compensation is not required to be reported. The Notice specifically provides that a covered employee does not need to have qualified as such at the end of the tax year as long as he or she met the definition at any time during the tax year. The Notice also specifies that once an employee is considered a covered employee in any year beginning after December 31, 2017 he or she will always be a covered employee, regardless of employment status.

Binding Contract

Material Modification

Conclusion

About Mullin Barens Sanford Financial

Disclaimer: The materials are designed to convey accurate and authoritative information concerning the subject matter covered. However, they are provided with the understanding that Mullin Barens Sanford does not engage in the practice of law, or give tax, legal or accounting advice. For advice in these areas please consult your appropriate advisors.

© 2025 Mullin Barens Sanford Financial and Insurance Services, LLC. All Rights Reserved.

2242 Purdue Avenue, Los Angeles, California 90064 |Website: www.mbsfin.com

Securities offered through M Holdings Securities, Inc., a Registered Broker/Dealer, Member FINRA/SIPC. #4444620